If you are looking for AAF Won't load. – Fallout 4 Technical Support – LoversLab you’ve came to the right place. We have 35 Images about AAF Won't load. – Fallout 4 Technical Support – LoversLab like Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation, Debug messages, after the installation of the AAF (Fallout 4) and also AAF THPoses at Fallout 4 Nexus – Mods and community. Here it is:

Table of Contents

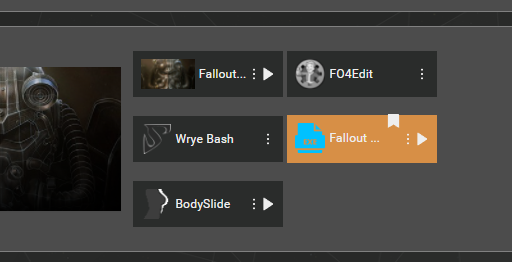

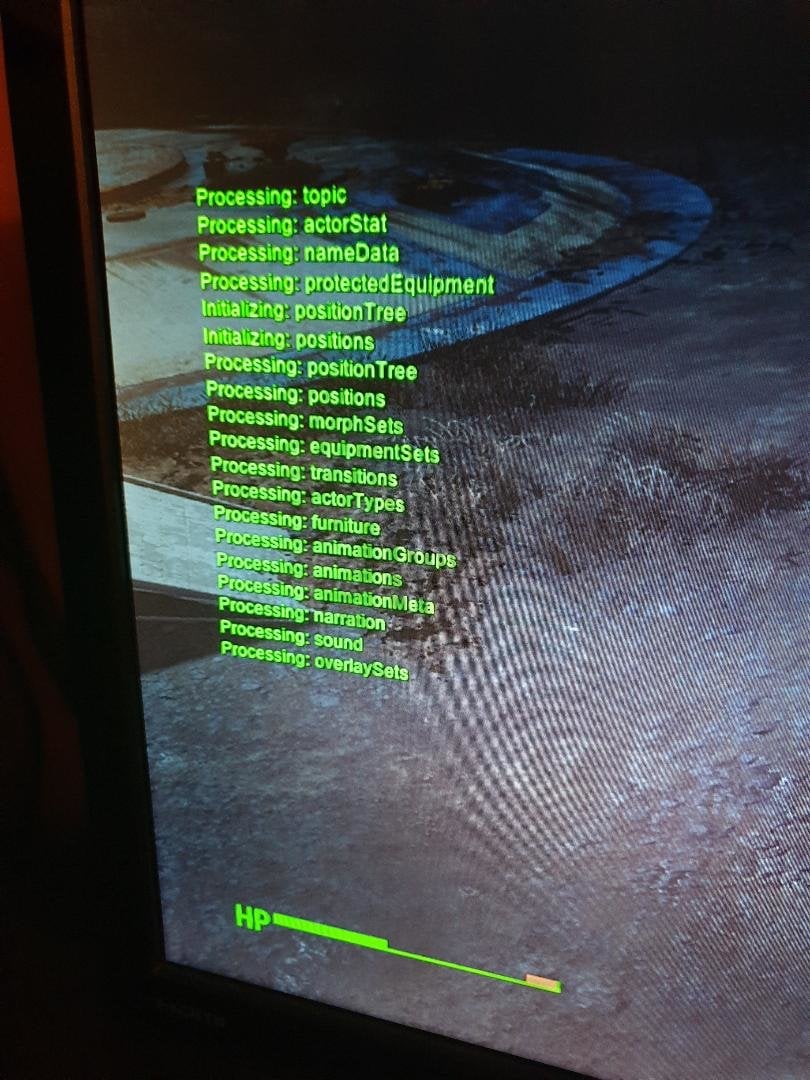

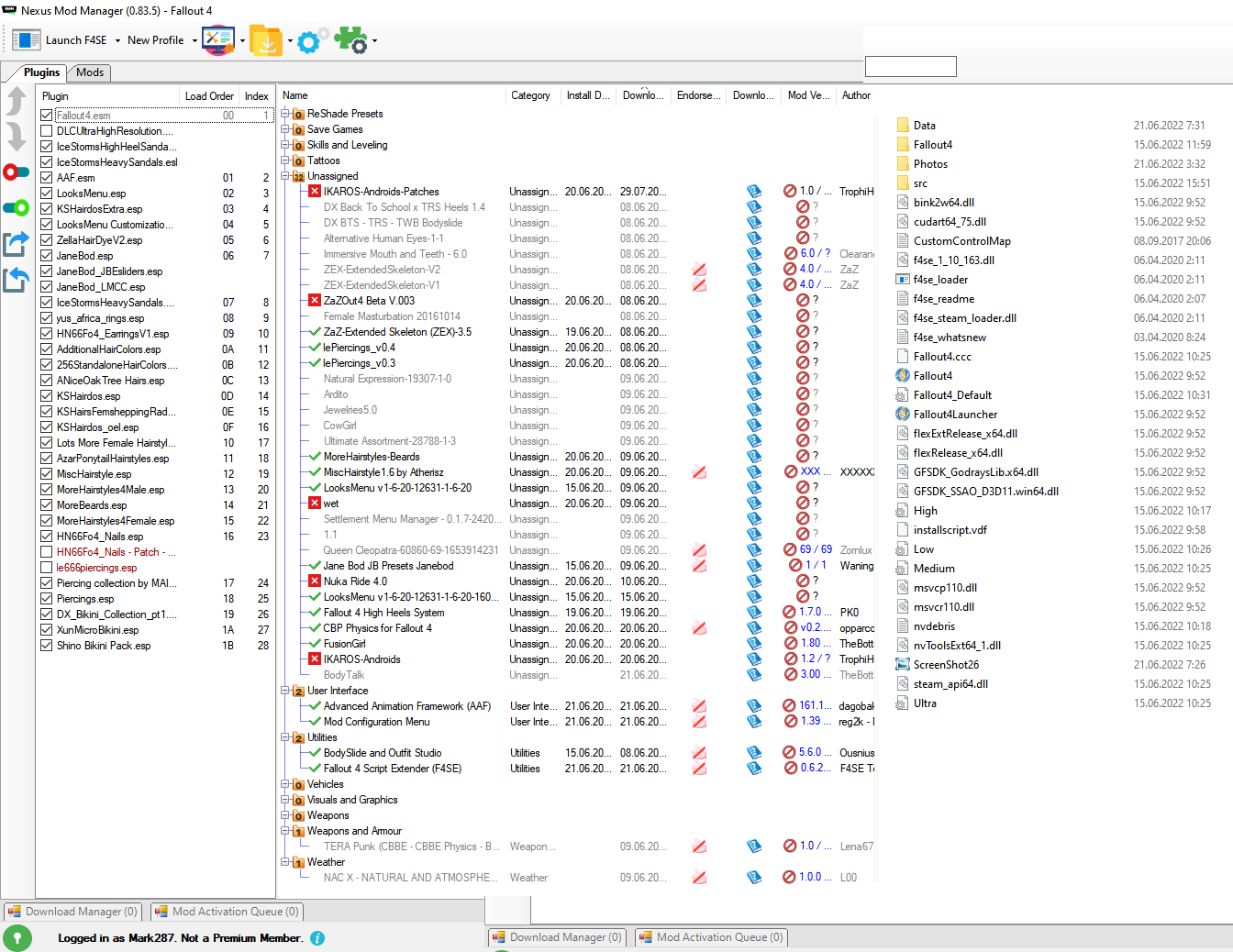

AAF Won't Load. – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf load fallout loverslab f4se won technical open

AAF Not Loading Properly? – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf properly loverslab

AAF Guide.pdf – AAF GUIDE INTRODUCTION SITES FOR FURTHER INFO AND

www.coursehero.com

aaf

4 Ways To Play Fallout 4 – WikiHow

www.wikihow.com

fallout wikihow

Going To Give FO3 A Playthrough. Modding Suggestions? – Fallout General

www.loverslab.com

[B!] 【Fallout4】Advanced Animation Framework(AAF)の使い方 – Fallout箱庭DIY

![[B!] 【Fallout4】Advanced Animation Framework(AAF)の使い方 - Fallout箱庭DIY](https://cdn-ak.f.st-hatena.com/images/fotolife/K/Kutsumiya/20180916/20180916111000.jpg)

b.hatena.ne.jp

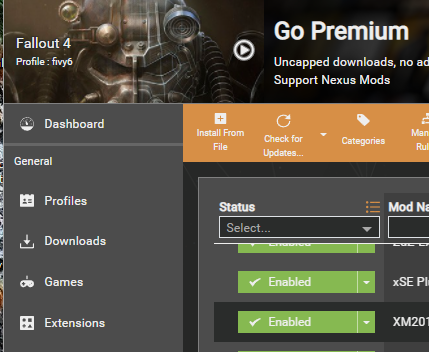

AAF | Fallout 4 | Nexus Mods

next.nexusmods.com

AAF Won't Load. – Page 4 – Fallout 4 Technical Support – LoversLab

www.loverslab.com

AAF THPoses At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf

Fallout 4 [HD] Gameplay Ultra Detail – Walkthrough Let´s Play (Part 14

![Fallout 4 [HD] Gameplay Ultra Detail - Walkthrough Let´s Play (Part 14](https://i.ytimg.com/vi/DhQVIkzAgN0/maxresdefault.jpg)

www.youtube.com

AAF THPoses At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf

Off-site Screenshot Test Poster

lpix.org

fallout

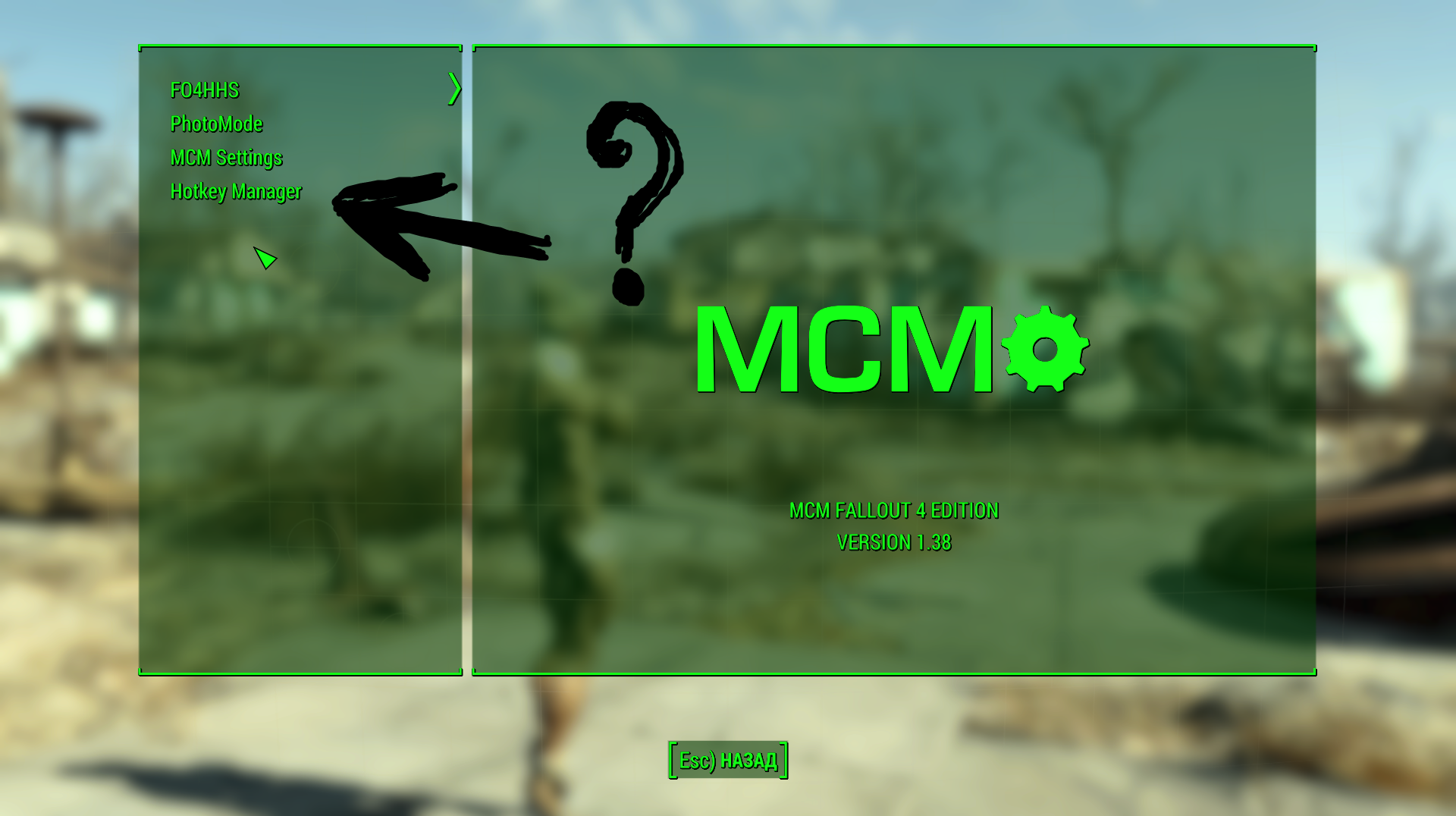

AAF Is Not Showing Up In The Mod Menu, In The Game Itself – Fallout 4

www.loverslab.com

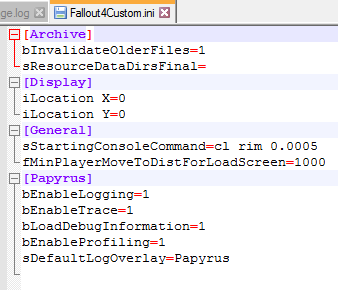

Fallout 4 Aaf How To Check Error – Hana-Oliver

hana-oliver.blogspot.com

Troubleshooting AAF – Page 23 – Technical Support – Advanced Animation

www.loverslab.com

aaf troubleshooting loverslab load something

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

AAF Problem Request – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab disadvantage

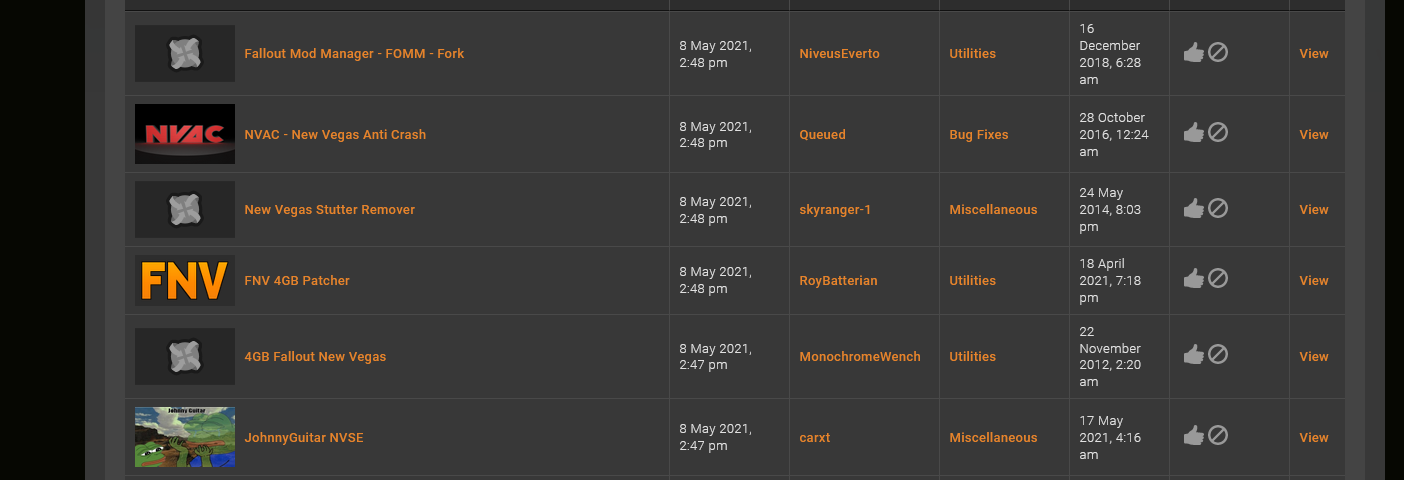

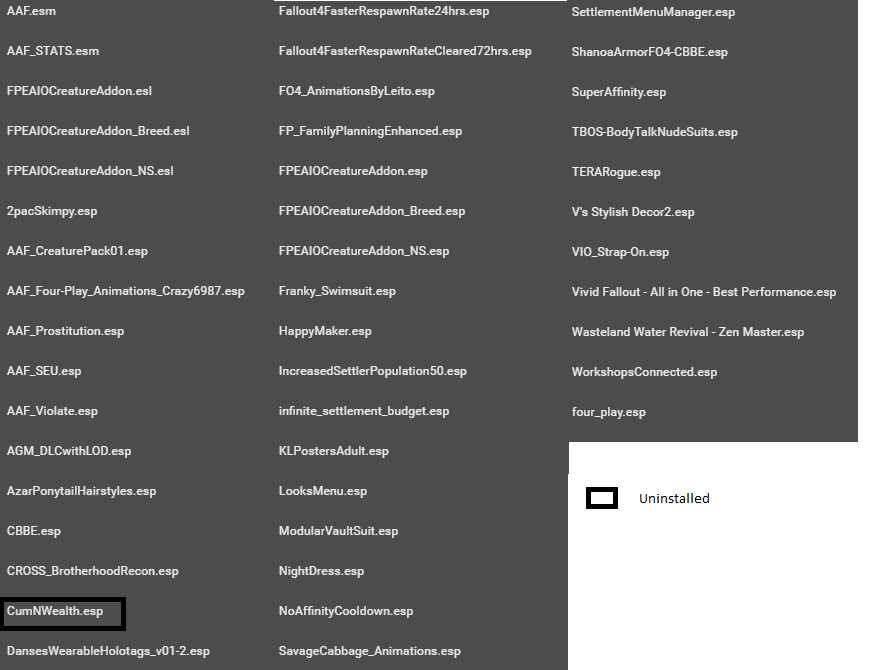

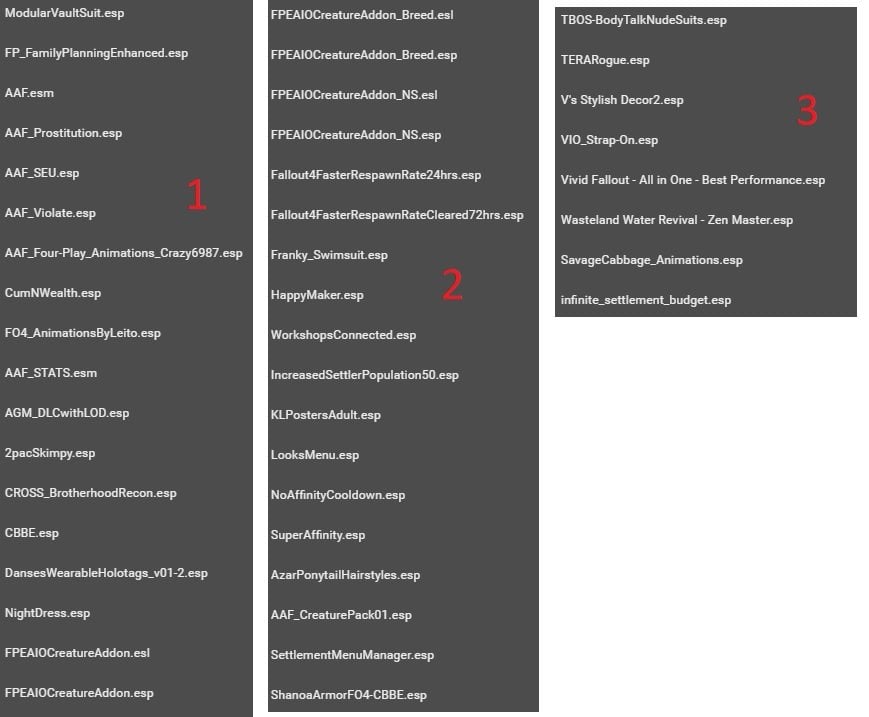

First Time Trying To Mod Fo4, Decided To Go With AAF Hardship/Beggar

www.loverslab.com

AAF Won't Load. – Page 4 – Fallout 4 Technical Support – LoversLab

www.loverslab.com

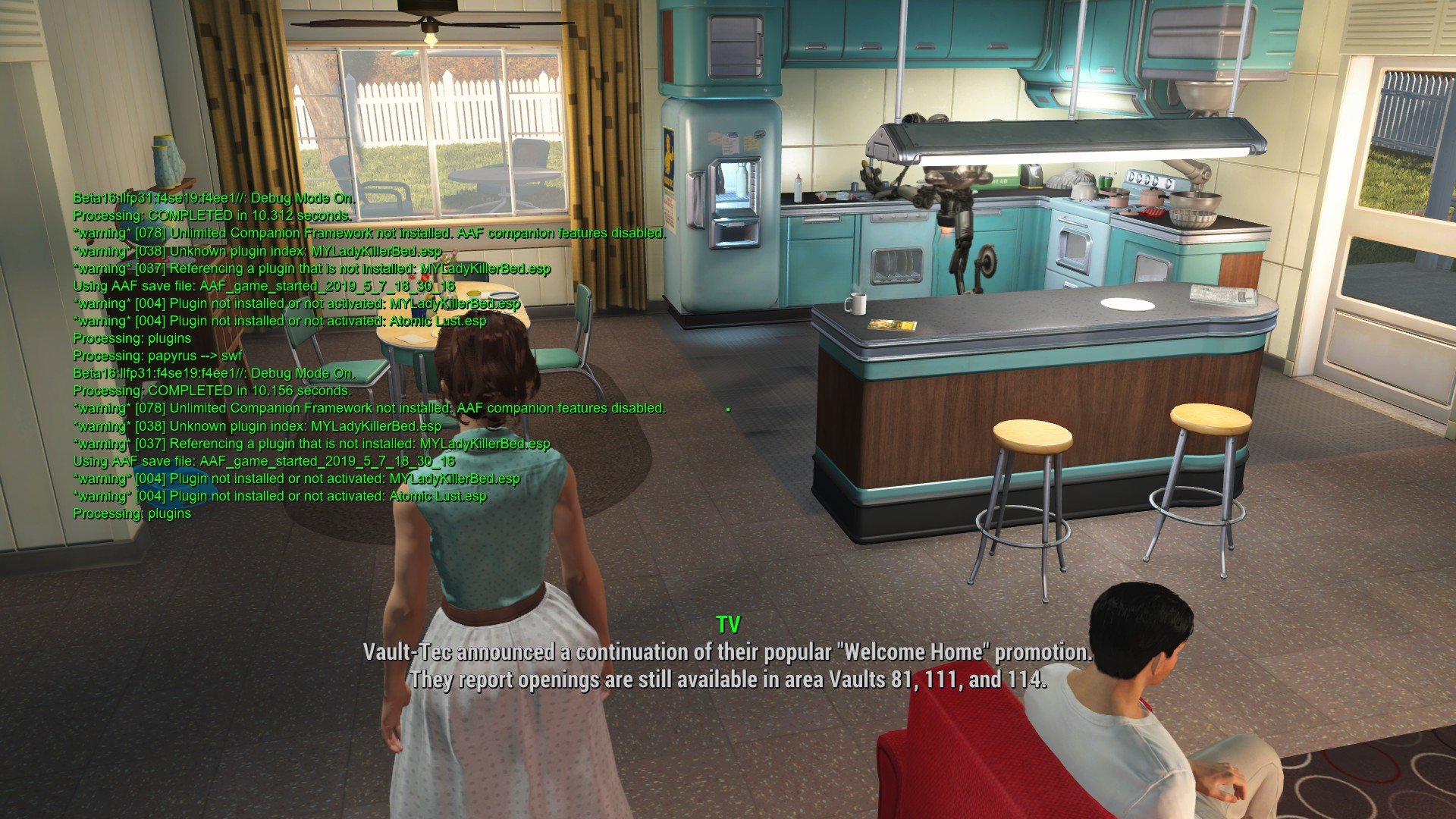

AAF Issue – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab fallout issue lust atomic link post

Need Help With AAF – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf need help loverslab

AAF Is Not Showing Up In The Mod Menu, In The Game Itself – Fallout 4

www.loverslab.com

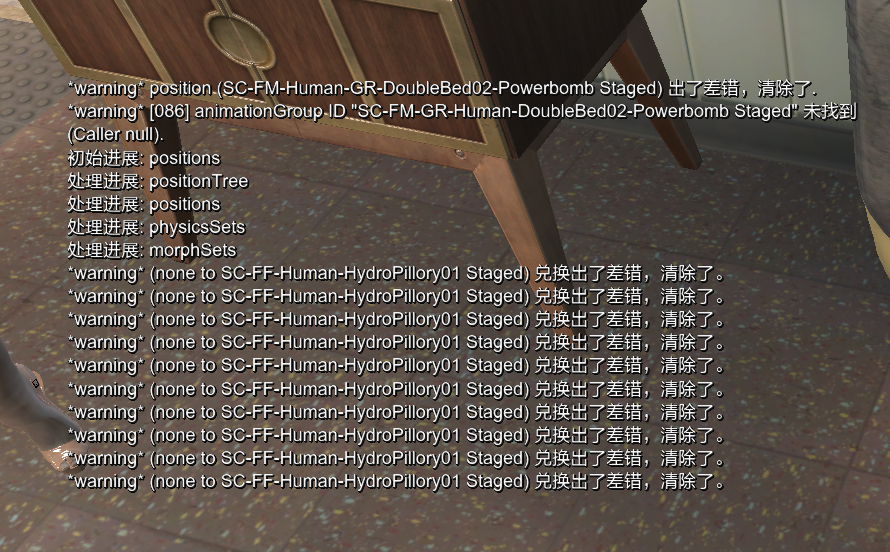

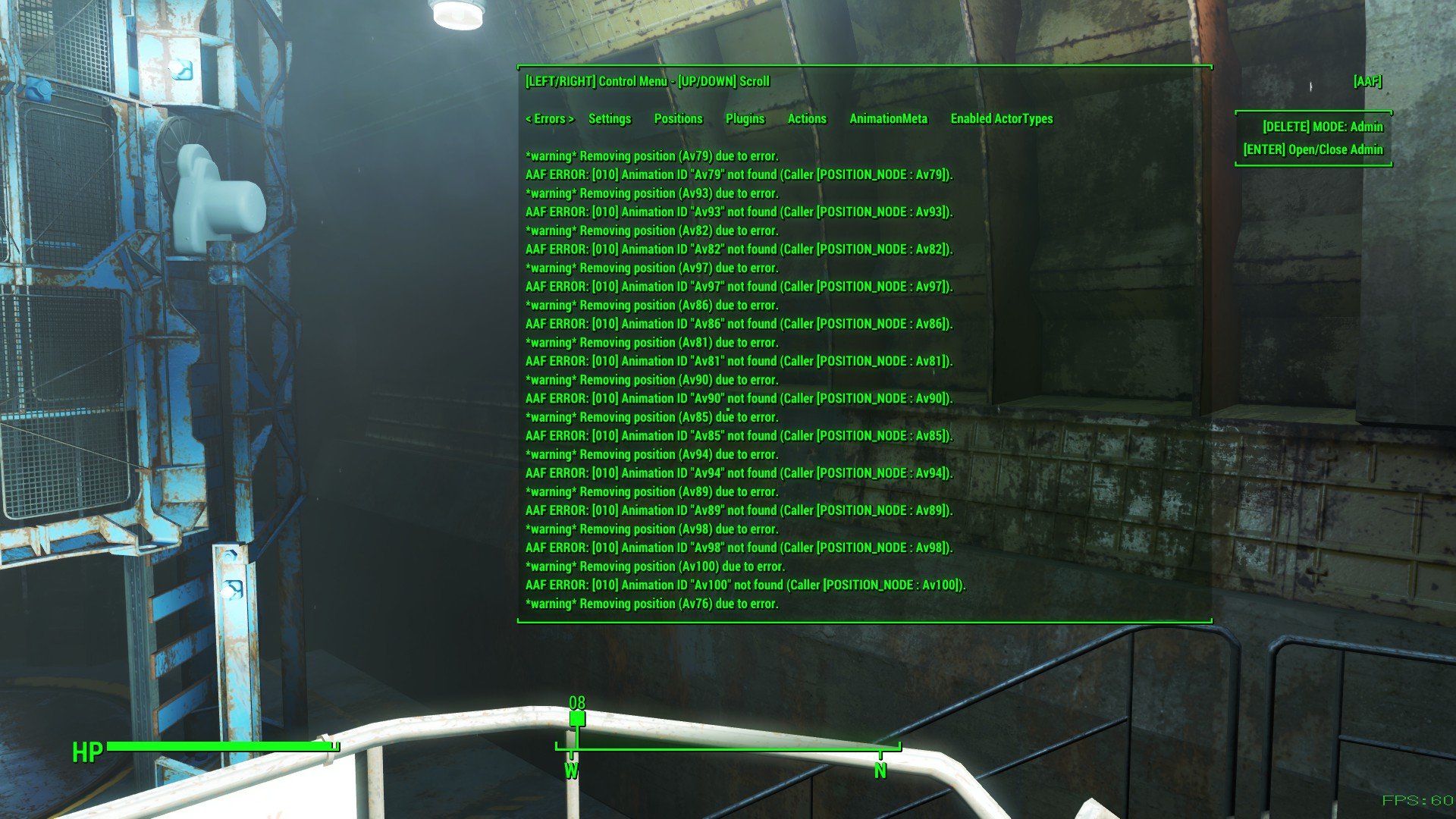

Debug Messages, After The Installation Of The AAF (Fallout 4)

sharehub.pro

fallout aaf debug installation messages after

Loverslab Fallout 4 Aaf Install Guide – Teamdaser

teamdaser.weebly.com

Need Help With AAF – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf need help loverslab

In AAF, What Is AV? – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab fallout pop

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

AAF – Basic Animations Theme At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf fallout loverslab mods animations basic pages theme use fallout4 bed downloads

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

Debug Messages, After The Installation Of The AAF (Fallout 4)

sharehub.pro

fallout debug messages aaf installation after spoiler

Troubleshooting AAF – Page 24 – Technical Support – Advanced Animation

www.loverslab.com

troubleshooting aaf loverslab spoiler

Poointelligence – Blog

poointelligence.weebly.com

How Fallout 4 AI Overhaul Works At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

Fallout 4 Aaf – Vvtigiga

vvtigiga.weebly.com

Need Help With AAF – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab

Fallout 4 [hd] gameplay ultra detail. Aaf not loading properly?. Need help with aaf

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games