If you are looking for Fallout 4 Place Everywhere Mod & F4SE (Full Newbies Tutorial) – YouTube you’ve came to the right place. We have 35 Pictures about Fallout 4 Place Everywhere Mod & F4SE (Full Newbies Tutorial) – YouTube like Fallout 4 goes post-nuclear in these high-res screenshots | GamesRadar+, How to Start Modding Fallout 4 in 2021 (MO2 + F4SE Tutorial) – YouTube and also How to install F4SE!! (Modding Fallout 4) – YouTube. Here it is:

Table of Contents

Fallout 4 Place Everywhere Mod & F4SE (Full Newbies Tutorial) – YouTube

www.youtube.com

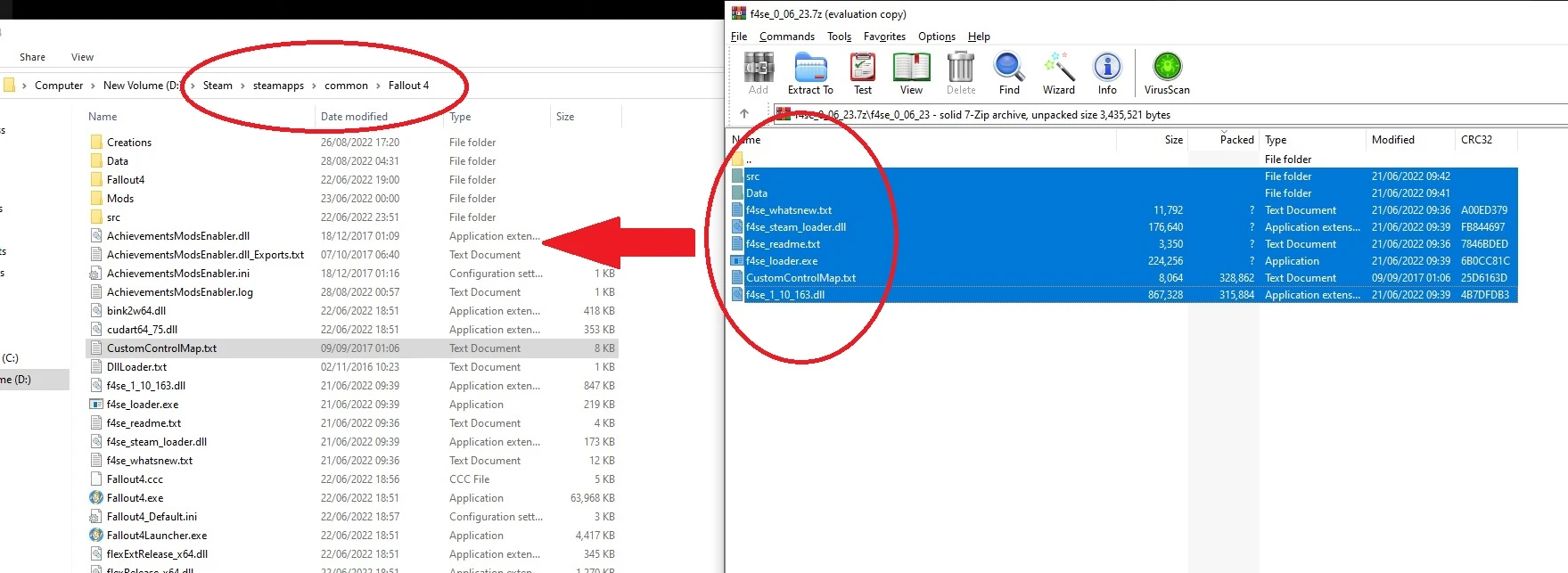

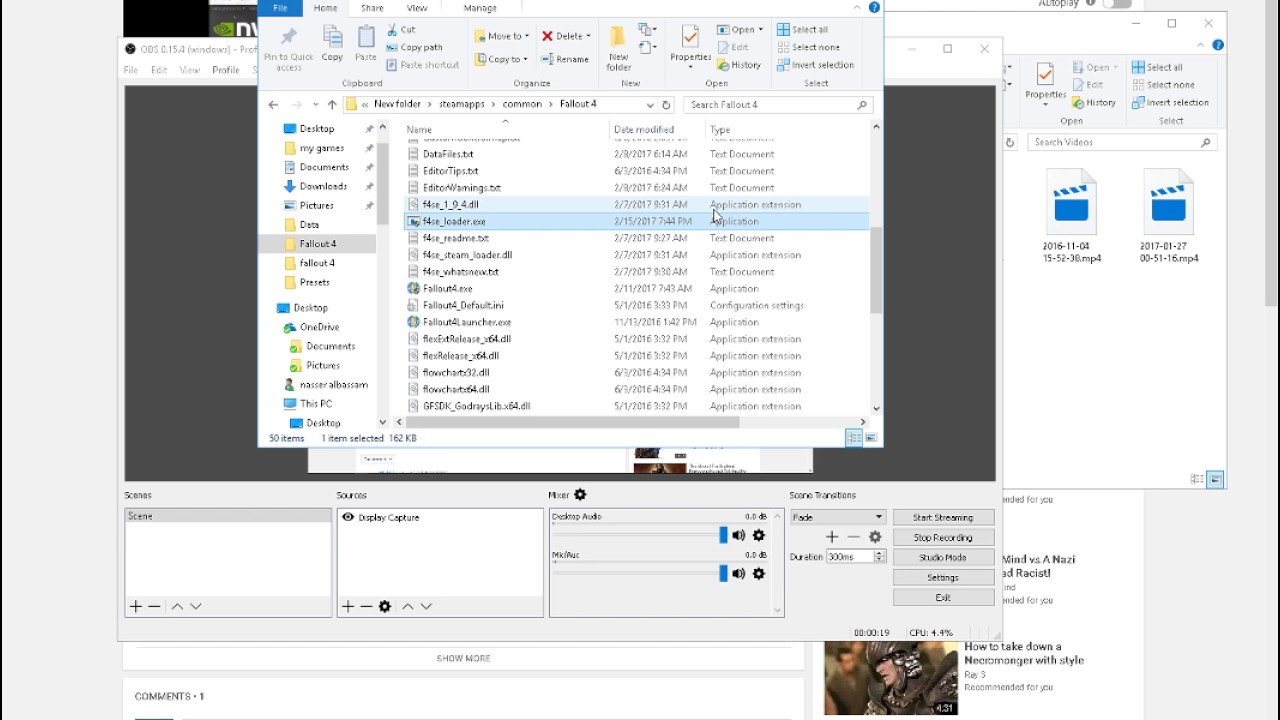

How To Install F4SE And Fix F4SE Not Working Error (2024)

itechhacks.com

f4se install itechhacks

F4SE – Page 3 – Fallout 4 Discussion – The Nexus Forums

forums.nexusmods.com

f4se

Fallout 4 F4SE Failing To Start – Fallout 4 Technical Support – LoversLab

www.loverslab.com

Steam Community :: Guide :: Run F4SE Through The Fallout 4 Launcher

steamcommunity.com

f4se fallout update after launcher directly needs might run because every through work

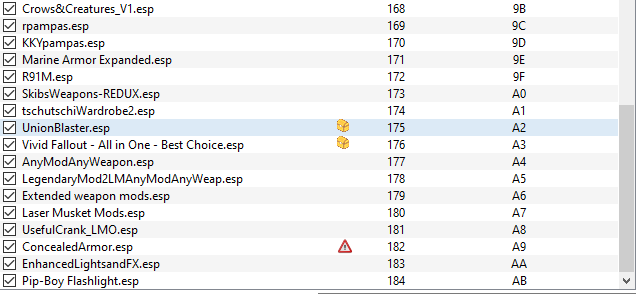

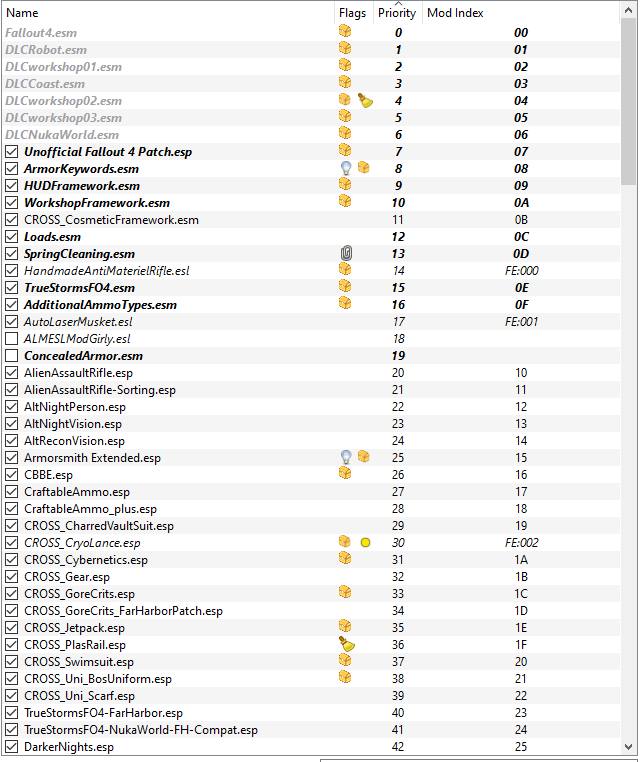

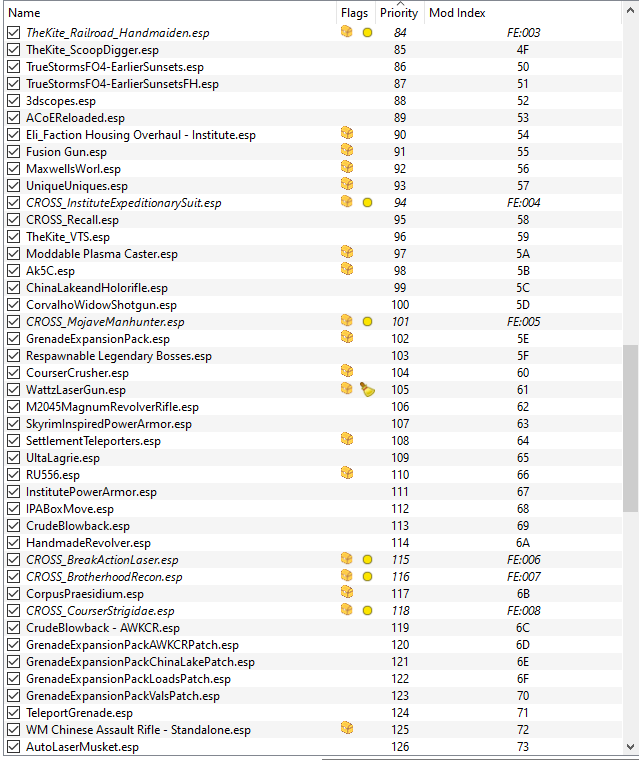

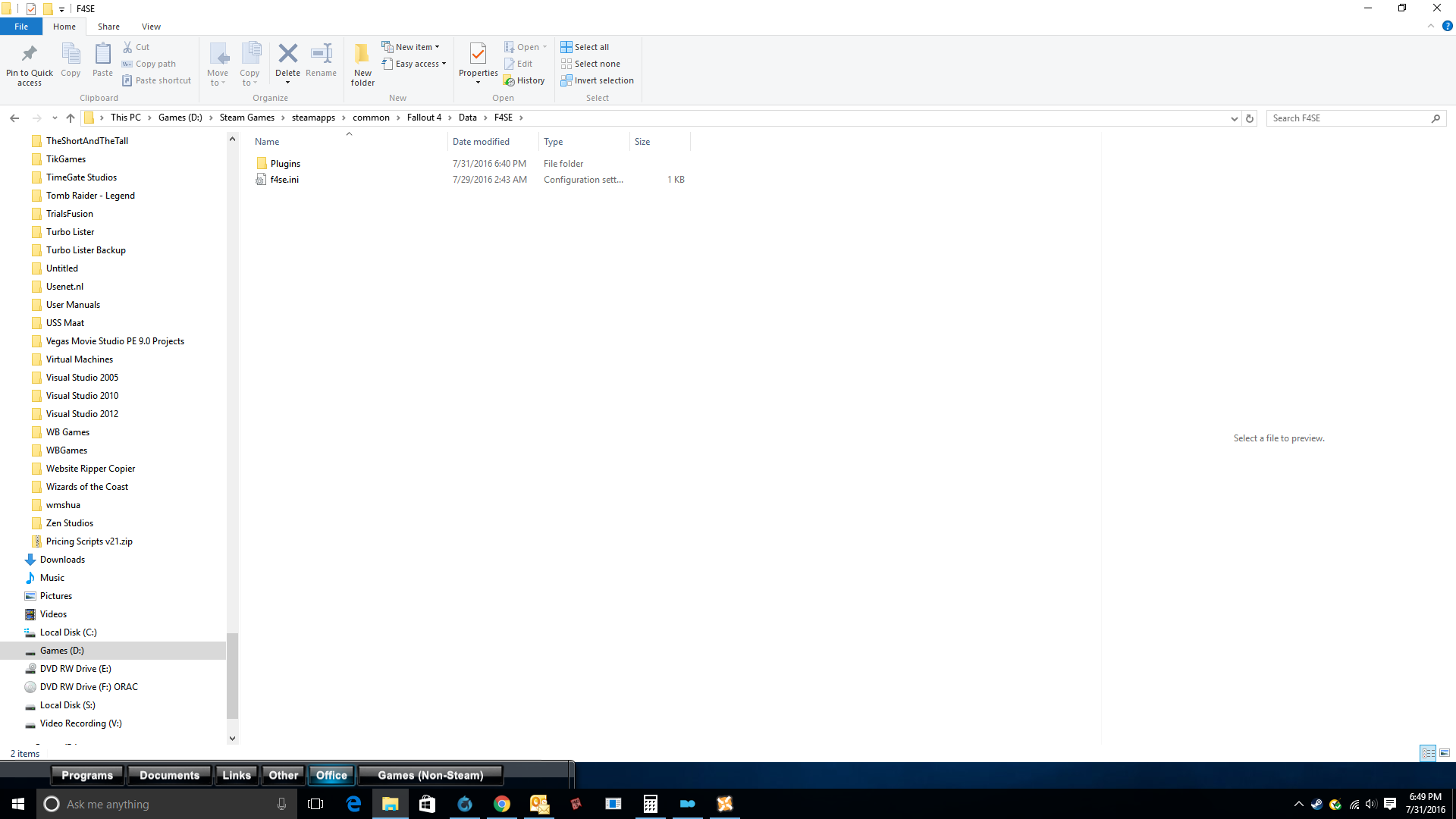

Verifying F4SE Plugin Installation At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

Quality Of Life Collection | Fallout 4 | Nexus Mods

next.nexusmods.com

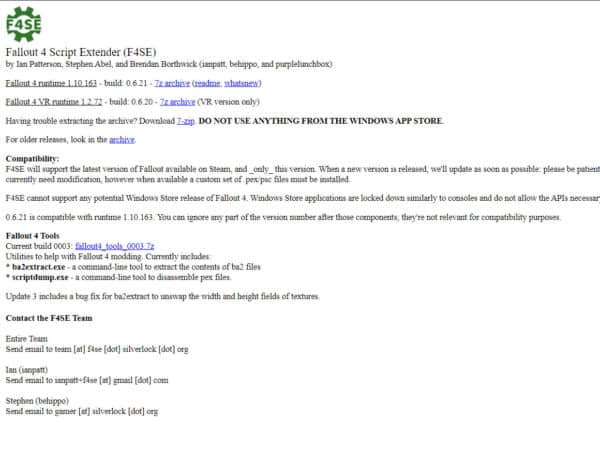

Fallout 4: F4SE – Updates, Help And Download – Guide And Tips

gamescrack.org

f4se fallout help updated gamescrack

Run F4SE With Fallout 4 Launcher その他 – Fallout4 Mod データベース MOD紹介・まとめサイト

fallout4.2game.info

Fallout 4 F4SE Failing To Start – Fallout 4 Technical Support – LoversLab

www.loverslab.com

How To Install F4SE For Fallout 4 (2020) – Script Extender V0.6.20

www.youtube.com

f4se fallout extender

The Game Does Not Start (f4se) – Fallout 4 Technical Support – The

forums.nexusmods.com

f4se start does game forums

Downgrade Fallout 4 To V1.7.19 Or Earlier (for F4SE Users) – YouTube

www.youtube.com

fallout f4se

Fallout 4: F4SE – Updates, Help And Download – Guide And Tips

gamescrack.org

f4se fallout gamescrack

FALLOUT 4 MOD I Classic Holstered Weapons System I Place Everywhere I

www.youtube.com

Fallout 4 F4se Crash Start – YouTube

www.youtube.com

Fallout 4: F4SE – Updates, Help And Download – Guide And Tips

gamescrack.org

f4se fallout gamescrack

F4SE Not Working: Fix Fallout 4 Script Extender Not Working

internettablettalk.com

How To Install F4SE For Fallout 4 (2018) – Script Extender V0.6.6 – YouTube

www.youtube.com

f4se install

F4SE Not Working On Fallout 4 [Fixed] – Techisours

![F4SE not working on Fallout 4 [Fixed] - Techisours](https://techisours.com/wp-content/uploads/2020/02/intro-1-300x158.jpg)

techisours.com

f4se fixed techisours

How To Start Modding Fallout 4 In 2021 (MO2 + F4SE Tutorial) – YouTube

www.youtube.com

mo2

Fallout 4 Place Everywhere Mod & F4SE Setup – YouTube

www.youtube.com

f4se

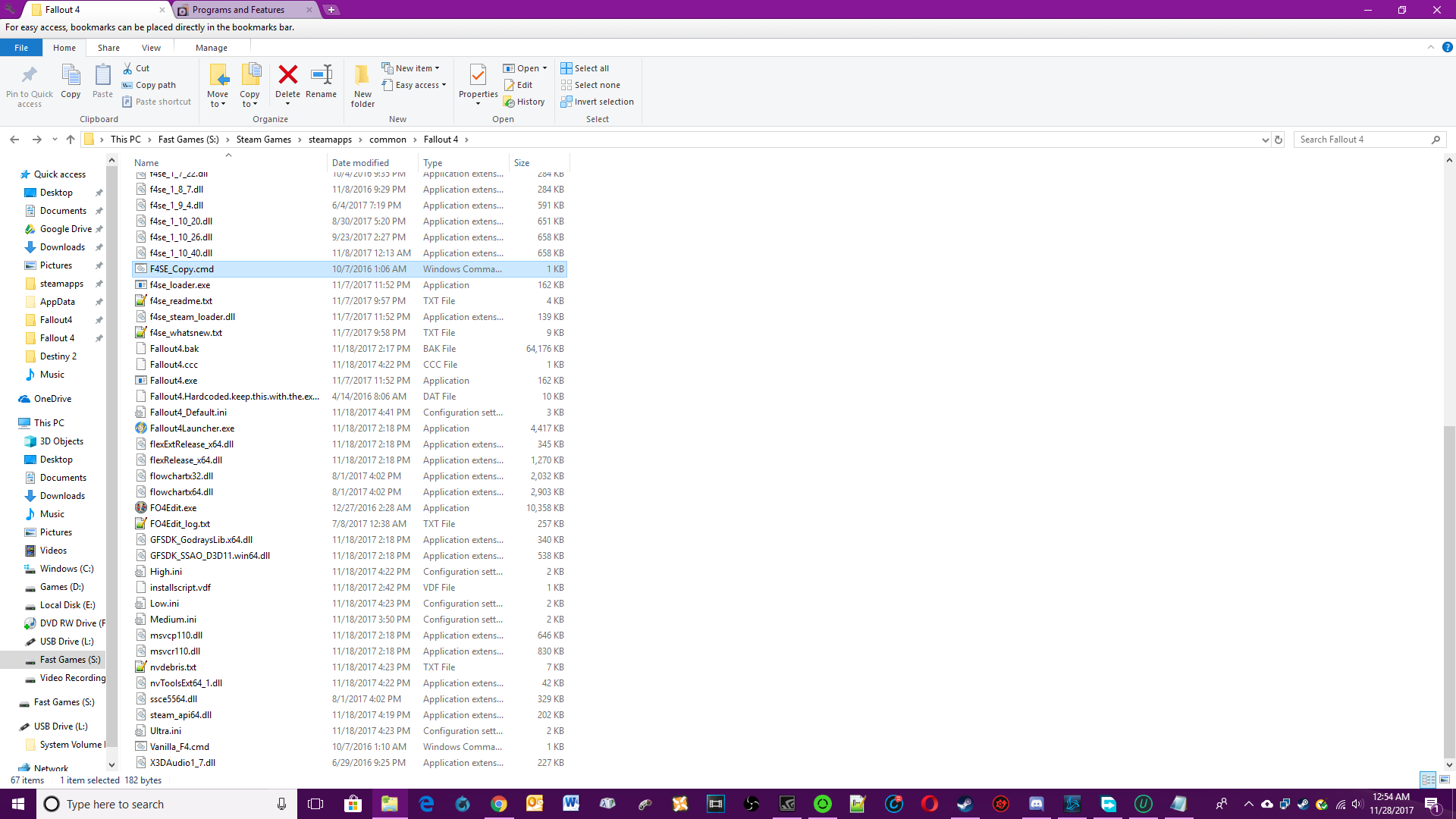

Steam Community :: Guide :: Fallout 4 F4SE Installation For Hardcore

steamcommunity.com

f4se fallout steam modding installation hardcore updates manual

FALLOUT 4 #9 – F4SE SCRIPT – COMO INSTALAR 2020 – YouTube

www.youtube.com

fallout f4se

【Fallout 4】「F4SE(Fallout 4 Script Extender)」の導入方法 【+Mod Organizer 2から起動

pcmodgamer.com

Run F4SE With Fallout 4 Launcher その他 – Fallout4 Mod データベース MOD紹介・まとめサイト

fallout4.2game.info

How To Fix Fallout 4 Script Extender Or F4SE Not Working – IR Cache

www.ircache.net

f4se extender ircache

[Archived] F4SE : Fallout 4 Script Extender [Update Linked] – YouTube

![[Archived] F4SE : Fallout 4 Script Extender [Update Linked] - YouTube](https://i.ytimg.com/vi/EdavUN4QghQ/maxresdefault.jpg)

www.youtube.com

Fallout 4 Goes Post-nuclear In These High-res Screenshots | GamesRadar+

www.gamesradar.com

fallout

Fallout 4 F4SE Failing To Start – Fallout 4 Technical Support – LoversLab

www.loverslab.com

[Fixed] My Game Works Without F4SE, But If I Try To Run FASE I Get CTD

![[Fixed] My game works without F4SE, but if I try to run FASE I get CTD](https://static.loverslab.com/uploads/monthly_2019_12/20191210145034_1.thumb.jpg.b6bbda40d816afc363907ebfb722dc5f.jpg)

www.loverslab.com

Fallout 4: How To Install F4SE – YouTube

www.youtube.com

How To Install F4SE!! (Modding Fallout 4) – YouTube

www.youtube.com

f4se fallout

How To Install F4SE (Fallout 4 Script Extender) : FalloutMods

www.reddit.com

fallout extender script

NMM And F4SE – Fallout 4 Mod Troubleshooting – The Nexus Forums

forums.nexusmods.com

f4se nmm nexus mod fallout troubleshooting launch

Fallout 4 f4se failing to start. Fallout extender script. F4se fallout steam modding installation hardcore updates manual

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games