If you are searching about AAF stuck at processing – Page 2 – Fallout 4 Technical Support – LoversLab you’ve visit to the right web. We have 35 Images about AAF stuck at processing – Page 2 – Fallout 4 Technical Support – LoversLab like Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation, Debug messages, after the installation of the AAF (Fallout 4) and also Troubleshooting AAF – Page 16 – Technical Support – Advanced Animation. Here you go:

Table of Contents

AAF Stuck At Processing – Page 2 – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf stuck processing loverslab fallout

[AAF] FO4 Animations By Leito – 12/21/18 – – Page 66 – Downloads

![[AAF] FO4 Animations by Leito - 12/21/18 - - Page 66 - Downloads](https://static.loverslab.com/uploads/monthly_2019_02/1194980514_Fallout42019-02-0322-06-43-55.jpg.5a0e99b846b418b314412c1d65f87bf4.jpg)

www.loverslab.com

aaf fo4 animations leito loverslab animation thx ur error requirement instructor installation even follow after hi got

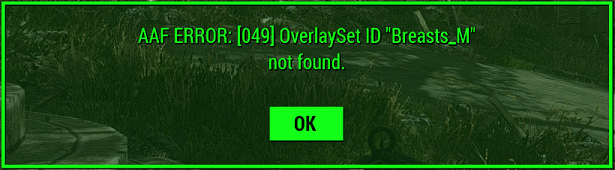

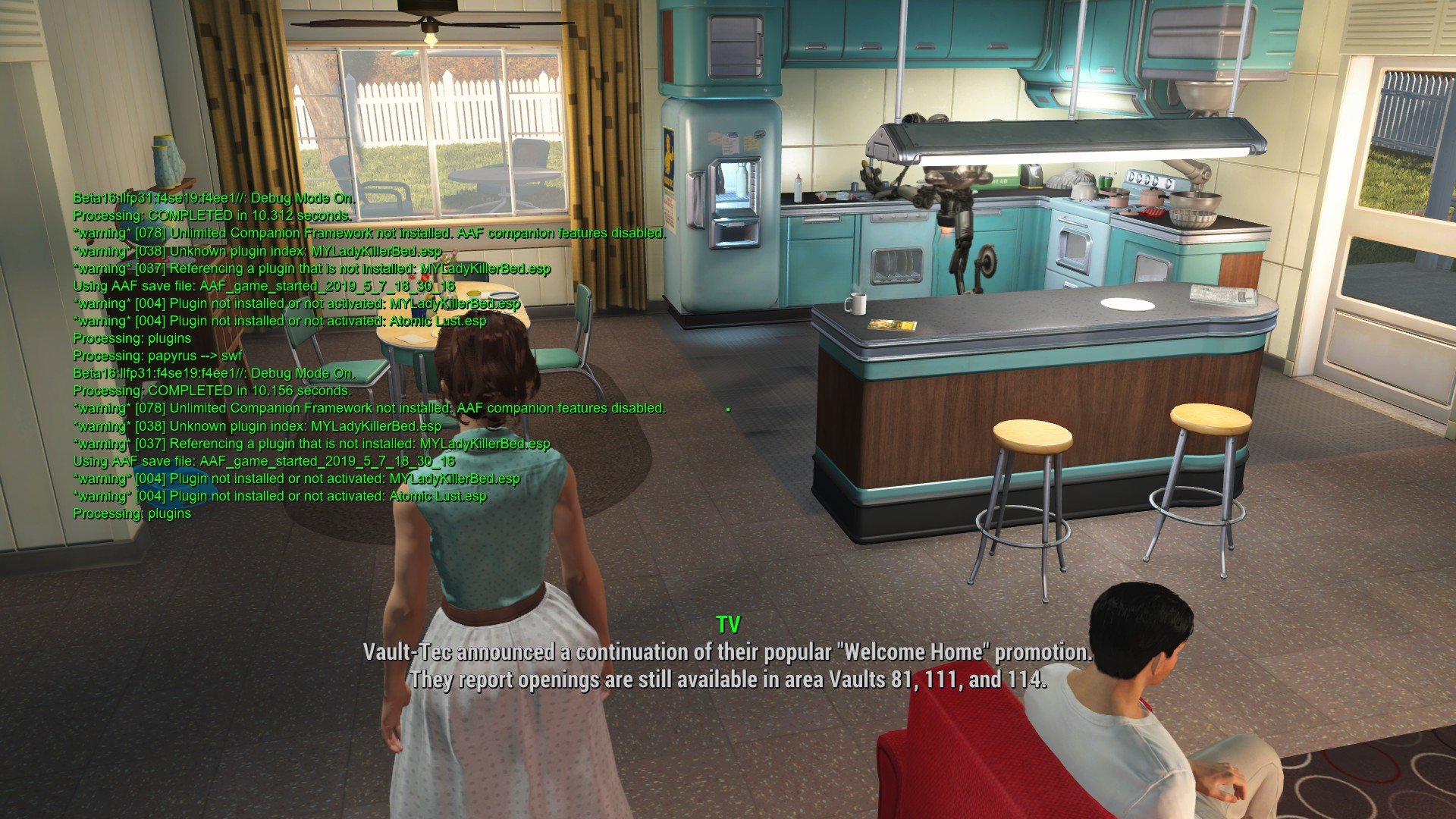

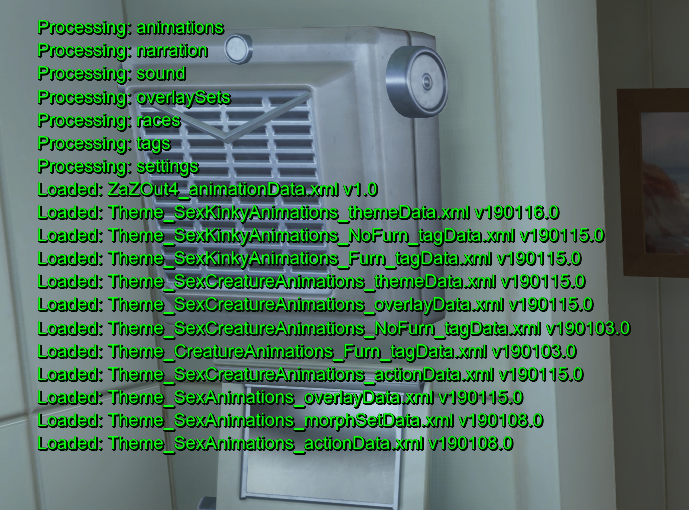

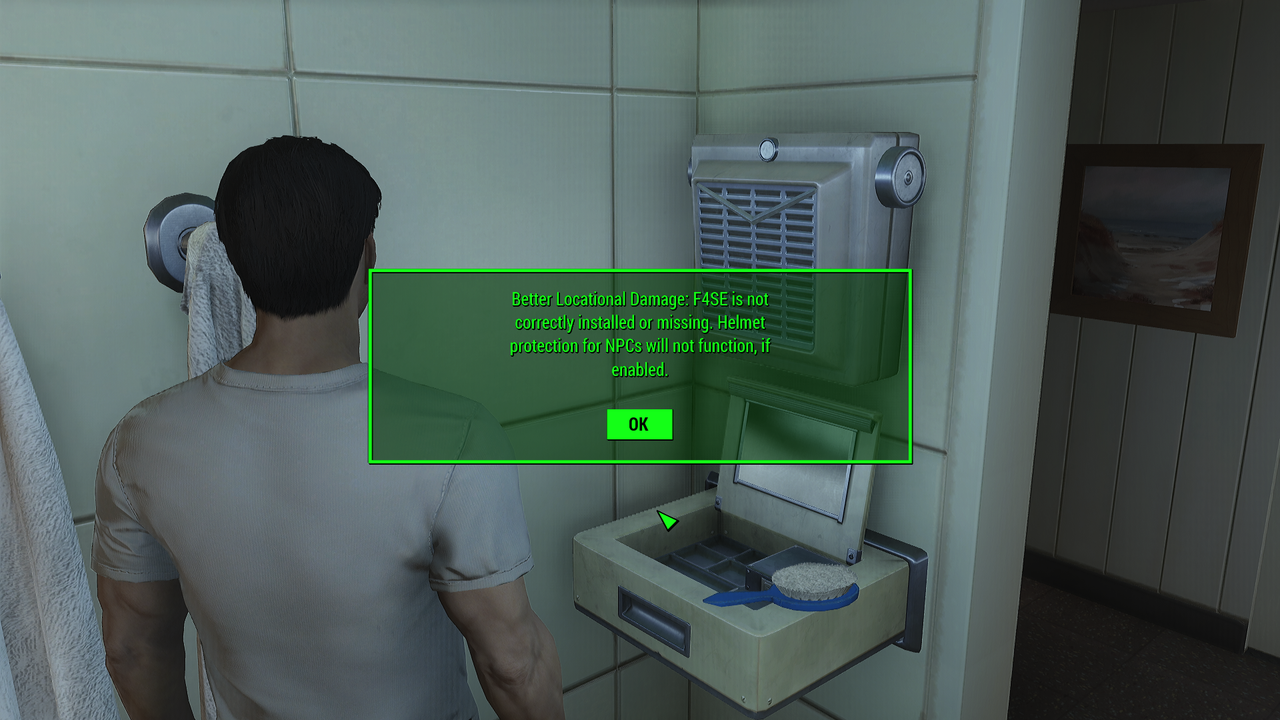

Debug Messages, After The Installation Of The AAF (Fallout 4)

sharehub.pro

fallout debug messages aaf installation after spoiler

Help Me Out With AAF, Cant Get It Working For Servitrons – Fallout 4

www.loverslab.com

aaf cant loverslab

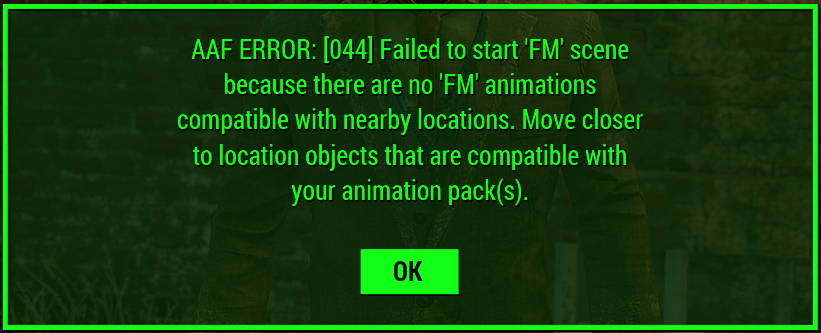

AAF Violate – Page 44 – Downloads – Advanced Animation Framework

www.loverslab.com

violate aaf spoiler animation

Fallout 4 Body Slider Mod – Marketingfasr

marketingfasr983.weebly.com

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

Debug Messages, After The Installation Of The AAF (Fallout 4)

sharehub.pro

fallout aaf debug installation messages after

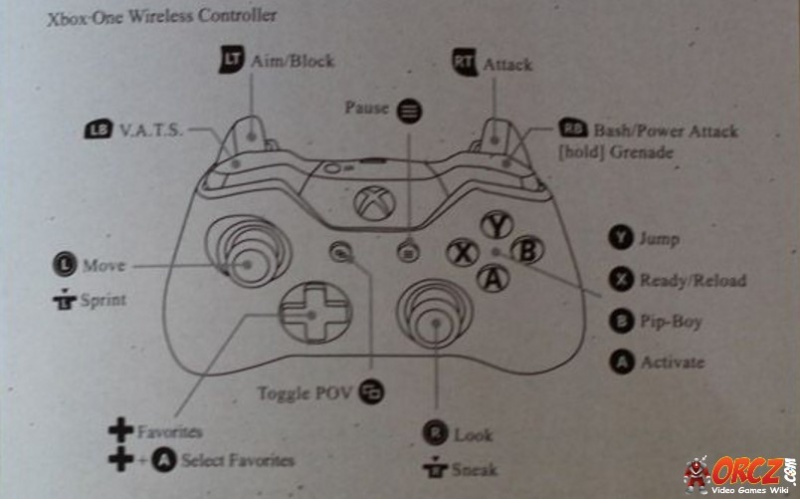

Fallout 4: Xbox One Controller Layout – Orcz.com, The Video Games Wiki

orcz.com

AAF – Basic Animations Theme At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf fallout loverslab mods animations basic pages theme use fallout4 bed downloads

AAF Violate – Page 122 – Downloads – Advanced Animation Framework

www.loverslab.com

aaf violate loverslab

Troubleshooting AAF – Technical Support – Advanced Animation Framework

www.loverslab.com

aaf troubleshooting loverslab overlay reinstalling patches solve setup ones problem installation need them only will

Troubleshooting AAF – Technical Support – Advanced Animation Framework

www.loverslab.com

aaf troubleshooting loverslab

AAF Issue – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab fallout issue lust atomic link post

AAF Creature Pack Release – Downloads – Advanced Animation Framework

www.loverslab.com

aaf pack creature loverslab release animation

Help With AAF – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf help loverslab fallout

AAF Not Loading Properly? – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf properly loverslab

AAF Menu – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf menu fallout loverslab processing forever anyone tell why these

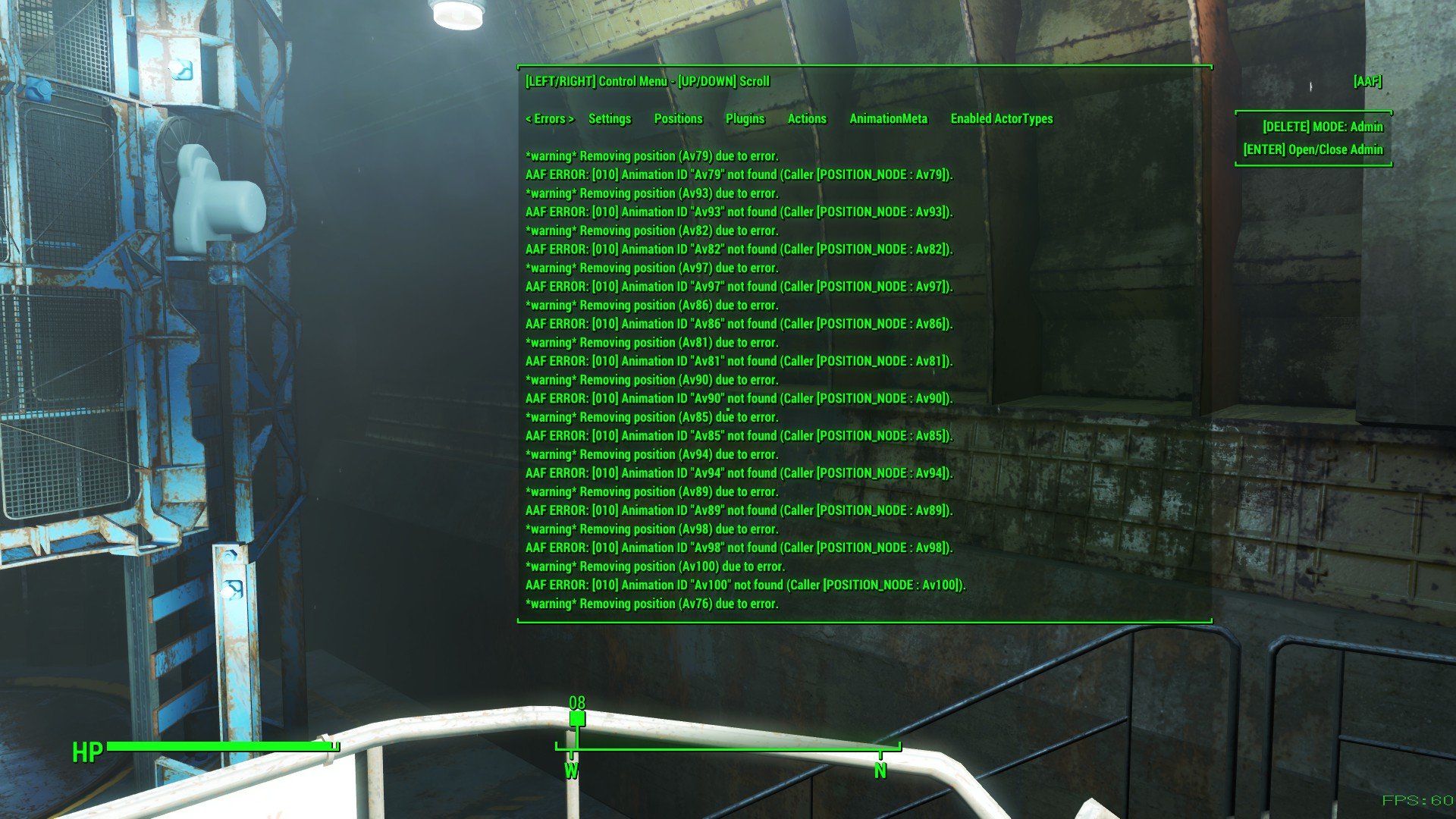

In AAF, What Is AV? – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf

Fallout 4 Aaf – Mzaercities

mzaercities.weebly.com

Loverslab Fallout 4 Aaf Violate – Quotedast

quotedast.weebly.com

AAF Test At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf test

Fallout 4 Aaf How To Check Error – Hana-Oliver

hana-oliver.blogspot.com

AAF Error 008 – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf error loverslab comment link

Advanced Animation Framework (AAF) At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf mods fallout framework advanced animation nexus dec uploaded

Advanced Animation Framework (AAF) At Fallout 4 Nexus – Mods And Community

www.nexusmods.com

aaf mods framework advanced animation fallout

In AAF, What Is AV? – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab fallout pop

Troubleshooting AAF – Page 16 – Technical Support – Advanced Animation

www.loverslab.com

aaf troubleshooting loverslab link post

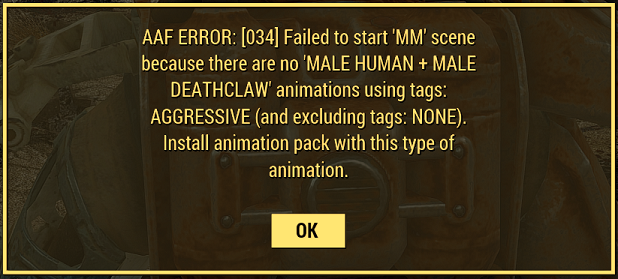

Troubleshooting AAF – Technical Support – Advanced Animation Framework

www.loverslab.com

animation aaf troubleshooting loverslab missing pack got

Missing Plugins/Mods For AAF – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf missing plugins loverslab fallout mods

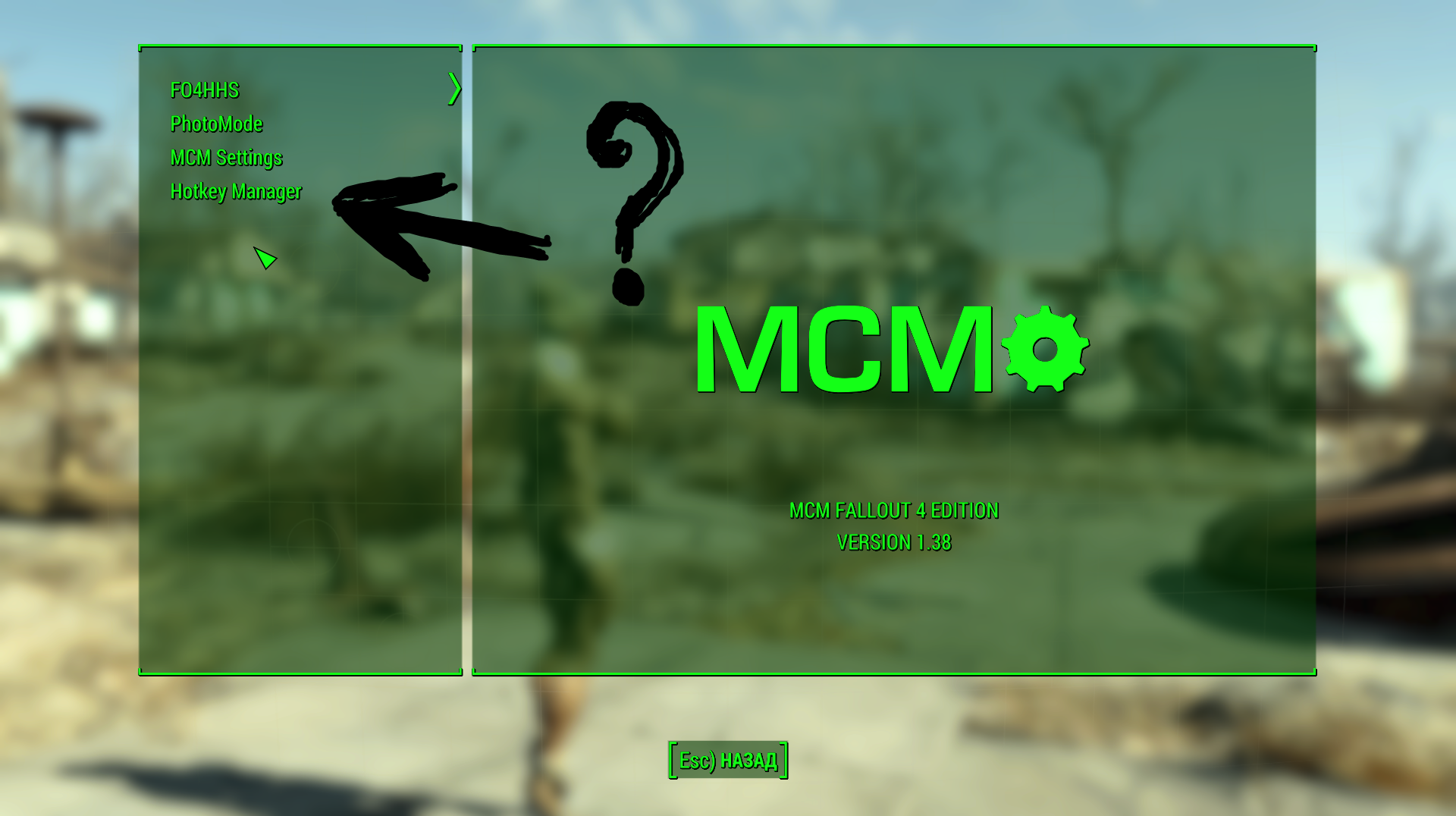

AAF Is Not Showing Up In The Mod Menu, In The Game Itself – Fallout 4

www.loverslab.com

AAF Won't Load. – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf load fallout loverslab f4se won technical open

Advanced Animation Framework (AAF) 日本語化対応 インターフェース – Fallout4 Mod

fallout4.2game.info

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

AAF Won't Load. – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf fallout

Aaf loverslab fallout issue lust atomic link post. Loverslab fallout 4 aaf violate. Aaf won't load.

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games