If you are looking for Sleeping In Graveyards: Embattled Afghan City Of Kunduz Facing you’ve came to the right place. We have 35 Pictures about Sleeping In Graveyards: Embattled Afghan City Of Kunduz Facing like Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation, Fallout 4 Four Play Violate – crimsonpp and also Let's Play Fallout 4 [20] (Initiate) – YouTube. Here you go:

Table of Contents

Sleeping In Graveyards: Embattled Afghan City Of Kunduz Facing

www.rferl.org

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

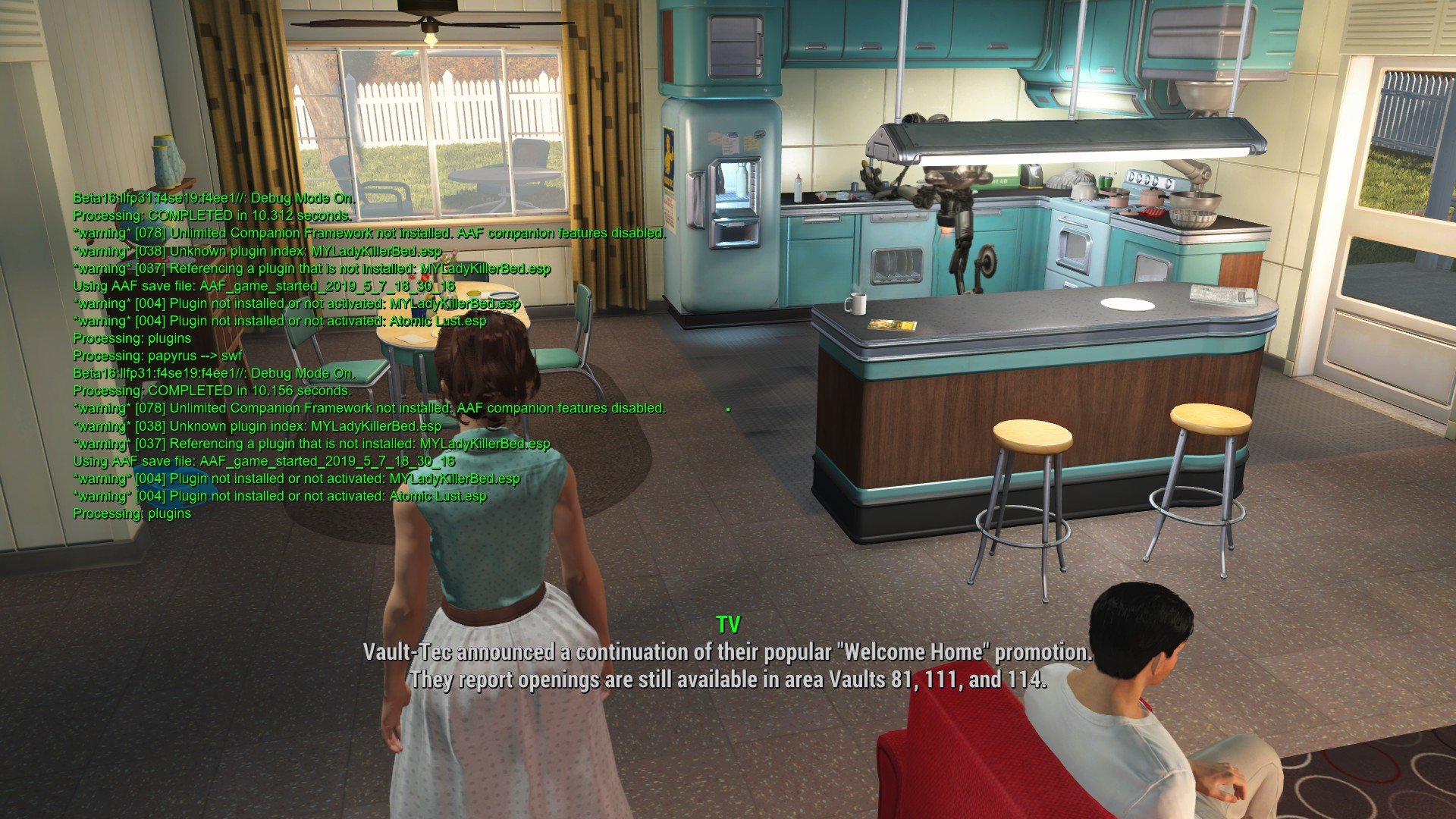

Fallout 4 Aaf How To Check Error – Hana-Oliver

hana-oliver.blogspot.com

[ FALLOUT 4 ] Full Play Through + DLC Ep.7 – YouTube

![[ FALLOUT 4 ] Full Play Through + DLC ep.7 - YouTube](https://i.ytimg.com/vi/2i38XWtO6c4/hqdefault.jpg)

www.youtube.com

AAF Won't Load. – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf load fallout loverslab f4se won technical open

An Attempt At Fallout 4 Ep 002 – YouTube

www.youtube.com

【Fallout4】Advanced Animation Framework(AAF)の使い方 – Fallout箱庭DIY

f4mod.hatenablog.com

Fallout 4 — Расширенная среда анимаций (AAF) / Advanced Animation

gig-life.ru

AAF Dangerous Nights: Dialogue Revamped! – Lovers Lab Fallout 4 RSS

schaken-mods.com

AAF Issue – Fallout 4 Technical Support – LoversLab

www.loverslab.com

aaf loverslab fallout issue lust atomic link post

12 More Things In Fallout 4 They Don't Tell You, But Advanced Players

www.theguardian.com

Fallout 3 | Let's Play Part 4 – Escape! – YouTube

www.youtube.com

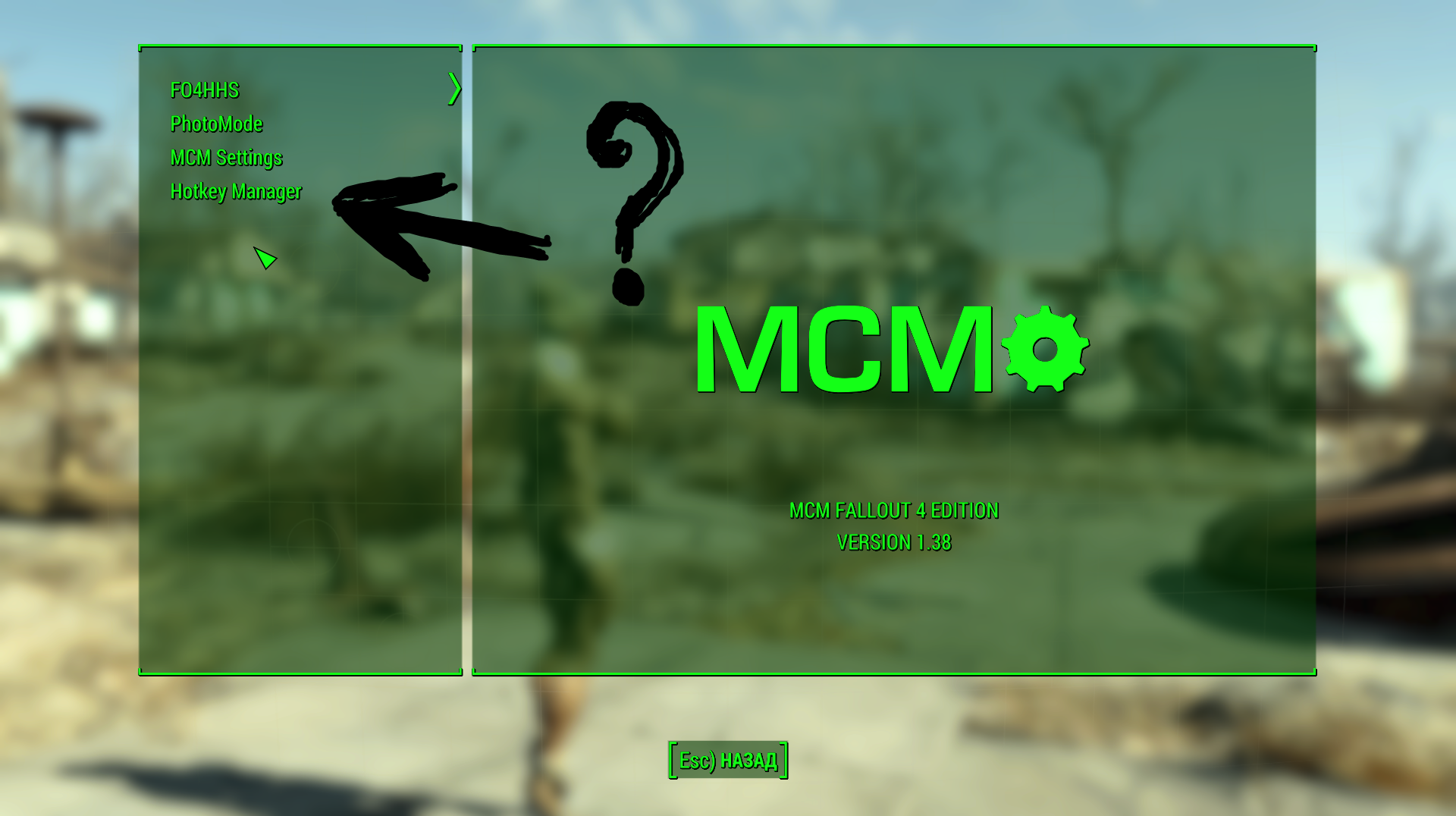

AAF Is Not Showing Up In The Mod Menu, In The Game Itself – Fallout 4

www.loverslab.com

Loverslab Fallout 4 Aaf Violate – Quotedast

quotedast.weebly.com

Fallout 4 Aaf – Vvtigiga

vvtigiga.weebly.com

Fallout 4 Four Play Violate – Crimsonpp

crimsonpp176.weebly.com

Poointelligence – Blog

poointelligence.weebly.com

Fallout 4_20151218214435.jpg – Directupload.net

www.directupload.net

Debug Messages, After The Installation Of The AAF (Fallout 4)

sharehub.pro

fallout aaf debug installation messages after

Who Did You Want To Romance In Fallout 4, But Couldn’t Without A Mod

www.quora.com

Fallout 4 Aaf How To Check Error – Hana-Oliver

hana-oliver.blogspot.com

Let's Play Fallout 3 [Live] Part 18 – F5 – YouTube

![Let's Play Fallout 3 [Live] Part 18 - F5 - YouTube](https://i.ytimg.com/vi/ZnBzo_vIJds/maxresdefault.jpg)

www.youtube.com

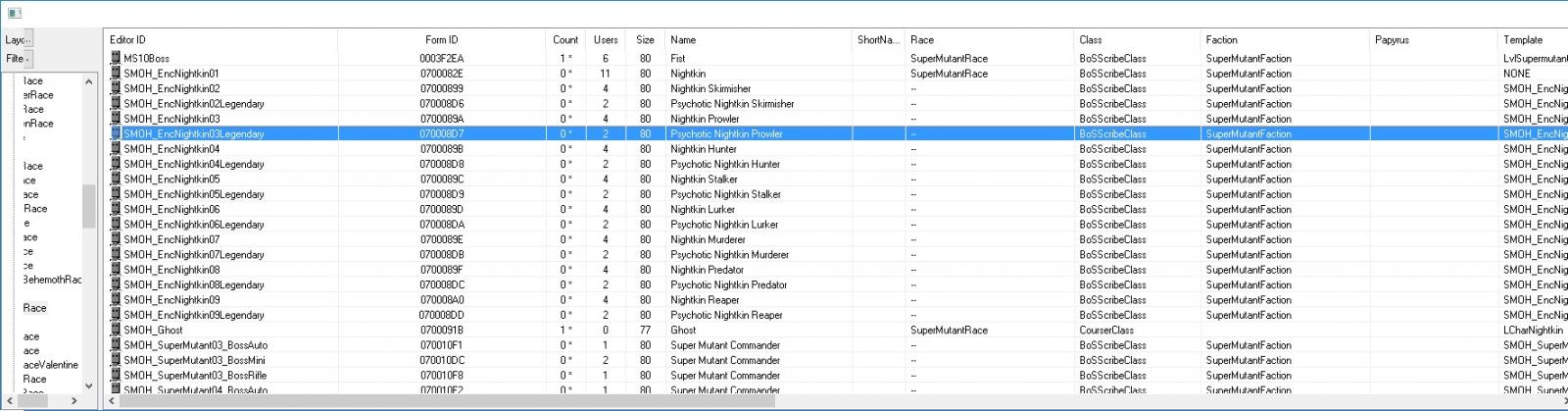

AAF Animations Not Playing – Technical Support – Advanced Animation

www.loverslab.com

animations aaf loverslab

[B!] 【Fallout4】Advanced Animation Framework(AAF)の使い方 – Fallout箱庭DIY

![[B!] 【Fallout4】Advanced Animation Framework(AAF)の使い方 - Fallout箱庭DIY](https://cdn-ak.f.st-hatena.com/images/fotolife/K/Kutsumiya/20180916/20180916111000.jpg)

b.hatena.ne.jp

Fallout 4 – Part 8 HOW FAR? (Let's Play / Gameplay) – YouTube

www.youtube.com

Fallout 4 Aaf – Mzaercities

mzaercities.weebly.com

Two Very Different Ways To Play Fallout 4 | Kotaku UK

www.kotaku.co.uk

fallout play ways different very two sanctuary leaving livingston christopher playing said yes without ever just

'Fallout 4' Won't Support User Mods This Fall – AIVAnet

www.aivanet.com

fallout aivanet

Playing Modded Af Fallout 4 – YouTube

www.youtube.com

AAF Violate – Page 122 – Downloads – Advanced Animation Framework

www.loverslab.com

aaf violate loverslab

Fallout 4 – YouTube

www.youtube.com

Let's Play Fallout 4 [20] (Initiate) – YouTube

![Let's Play Fallout 4 [20] (Initiate) - YouTube](https://i.ytimg.com/vi/JBp-SAzKQ7M/hqdefault.jpg)

www.youtube.com

Let's Play Fallout 4 Ep. 2 – YouTube

www.youtube.com

fallout

AAF Not Playing Animations – Technical Support – Advanced Animation

www.loverslab.com

aaf animations loverslab spoiler

AAF Error [74] – Fallout 4 Technical Support – LoversLab

![AAF Error [74] - Fallout 4 Technical Support - LoversLab](https://static.loverslab.com/uploads/monthly_2019_03/Fallout4_2019-03-28_17-36-59.png.899f96ac13908cdc0f3d8e81ed2f56ec.png)

www.loverslab.com

aaf error loverslab fallout

Fallout 4 four play violate. Aaf dangerous nights: dialogue revamped!. Aaf not playing animations

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games

ataylormadelife.com ataylormadelife.com adalah website berita yang memberikan informasi seputar teknologii dan games